HERE IS THE TRUTH BEHIND RECENT NEWS HEADLINES

Seemingly overnight – there has been a TON of news about this unfair tax for borrowers with higher credit scores and high down payment. So before we start telling anyone to stop paying their bills in hopes for a better interest rate, we wanted to separate fact from fiction!

LLPAs: Loan Level Price Adjustments

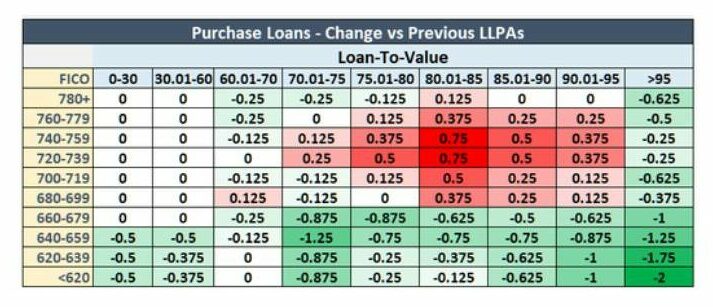

This all has to do with changes to Fannie Mae and Freddie Mac’s LLPAs. LLPA’s are all based upon things like credit score, and total down payment. LLPAs have been changed over the years, but a substantial change was announced January of this year. The changes go into effect on loans delivered on or after May 1st of 2023. However, most investors have implemented these changes months ago.

The “heat map” (table 1) that most people are so upset about, is how the interest rate pricing fees (LLPAs) have changed. It’s NOT representative of the actual rate pricing fee schedule (table 2). What everyone is hyper-ventilating over: Fee schedule CHANGES.

The “heat map” (table 1) that most people are so upset about, is how the interest rate pricing fees (LLPAs) have changed. It’s NOT representative of the actual rate pricing fee schedule (table 2). What everyone is hyper-ventilating over: Fee schedule CHANGES.

Table 1

Differences in LLPAs before and after the change.

RED = Rising Costs

Green = Lower Cost

RED = Rising Costs

Green = Lower Cost

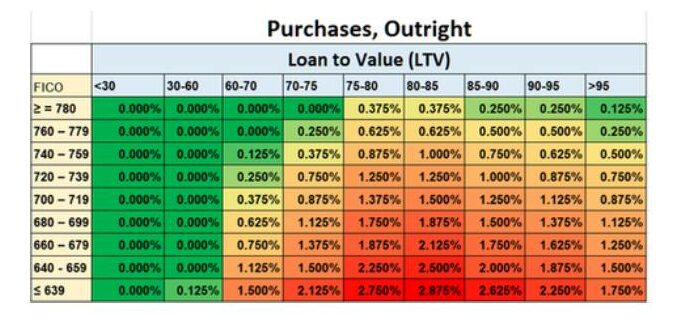

Table 2

So as you can see from table 2, if you have a credit score of 640, you’ll be paying significantly more than if you had a 740 credit score.

Why the change? Fannie and Freddie technically have a mission to promote affordable home ownership. The change in price adjustments is in favor of those with lower credit scores, to “level the playing field” so to speak. So NO, a low credit borrower isn’t paying less than a high credit borrower, the gap between what they are paying is just smaller than it was.

KEY TAKEAWAYS

Have The Fee Changed?

Yes.

Are we now giving “BETTER DEALS” to lower credit

score individuals (compared to higher score

individuals)?

No!