Are you sick of paying rent? Taking out a mortgage is easier than you may think. Especially when you have a knowledgeable and caring team like ours to guide you along the way! Today we want to address common concerns and frequently asked questions we get from new home buyers.

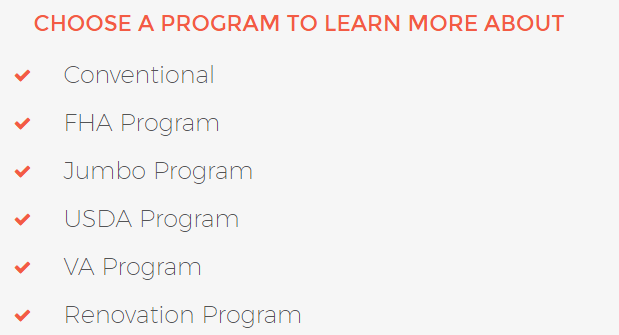

There are a few different mortgage programs and financing options, by the end of this article hopefully you’ll have a better idea of which one works BEST for you!

Meeting your mortgage needs is our number one goal, lets get started!

What if I can’t afford a 20% Down Payment?

Its unrealistic to think everyone has that 20% down payment stashed away in their bank. Luckily there are other mortgage options to help meet everyone else’s needs.

For example, with an FHA Loan, lenders require less money from the borrower upfront. This low down payment can be as little as 3.5% down! With this low down payment also comes possibly a higher monthly payment or less equity in the home when you’re ready to sell.

To learn more about our different Mortgage Programs, click here!

I have children in elementary school, I want to pay off my mortgage before they leave to college. How can I do that?

With a 15 year fixed rate loan you’re gaining equity in your home quicker and paying off your loan faster. If you don’t mind a higher monthly payment, a Conventional Loan may your best pick, click here to learn more!

You could set realistic and attainable financial goals that will help you to pay your mortgage loan off faster. Meet with a financial adviser or do some research. Many have done it and so can you! Here’s a great article that can offer you some tips: http://www.quickanddirtytips.com/money-finance/loans/8-ways-to-pay-off-a-mortgage-early

I don’t have the best credit score, what type of mortgage should I look for?

Borrowers with a lower credit score are more likely to get approved if they apply for an FHA Loan. Scores can be a low as 580! However you will still need to do some explaining why your score is so low, how you plan on improving it, etc. Click here to learn more about how to clean up your report and prepare your credit for the mortgage loan process.

What else should I take into consideration when I’m buying a home and taking out a mortgage?

Get information from other lenders, do your research, shop around, and make sure you’re getting the best possible price. Here at Sun American we have the best rates and prices in the Valley! Our reviews on Google and Facebook beat any other mortgage business in town, here’s some of our most recent ones!

I’m not too sure how long I’ll be living in my current city…should I still take out a mortgage right now?

Real Estate professionals recommend taking into consideration how long you’ll be staying in that area. A 15 year or 30 year mortgage is the best way to go if you’re pretty uncertain. This gets you the most equity in your home.

What are closing costs and how much will they be?

Closing costs are fees that come along with your home purchase and are paid at the end of the real estate transaction. In a recent survey done on Zillow.com, on average buyers will pay roughly $3,700 in closing fees. The Loan Estimate from the beginning will give you a pretty good idea of what you’re closing costs will be.

This week we celebrate 33 YEARS of helping individuals become home buyers! Whatever your concerns or questions may be, we always answer them as thoroughly as we can. The best part of our job is making this new chapter exciting for you and your family. Meeting your mortgage needs is our top priority!

Call to speak to one of our expert team members today! 480-832-4343

References:

https://www.trulia.com/blog/type-mortgage-best/