You may have just stumbled on the perfect option for you and your family. There are no catches to this NO down payment loan program, and we are super excited to share it with you!

So you know you don’t want to rent anymore, but coming up with the required down payment scares you a little. You are definitely not alone. This is why there’s another loan program aside from traditional loans or the FHA option that can really help you out.

What is the USDA Program?

This is a home loan that’s guaranteed by the US Department of Agriculture, aka USDA. It provides an incentive for families to buy a home in a rural area. This helps our nation’s smaller, rural communities thrive by making property more affordable.

The USDA loan program serves a fraction of the US housing market and most banks actually don’t offer them. However, here at Sun American Mortgage we DO offer this no down payment loan program and it comes with MANY other benefits!

So what are some more “pro’s” of this no down payment loan program?

How It Works?

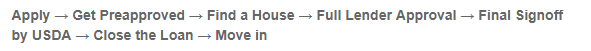

There is a traditional process that comes with a USDA loan program. It looks something like this..

Saving for a down payment can be difficult for most families. The only other loan program that doesn’t require a down payment is the VA program. That’s why this is such a great opportunity to get your hands on!

Who Can Qualify?

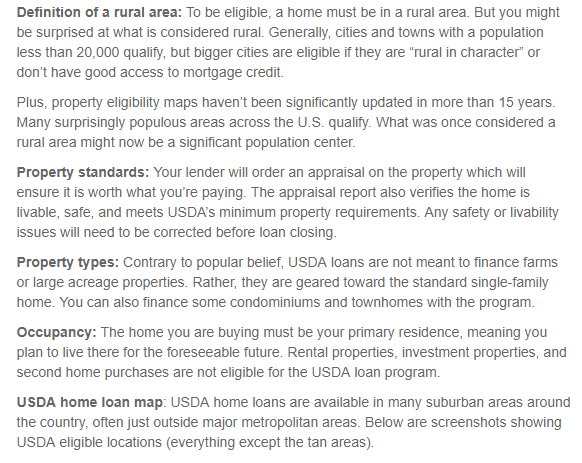

Do you feel more at home surrounded by trees, farmland, and pastures versus living in the city or a suburban community? A USDA loan program is probably the best fit for you! There are different eligibility requirements for the borrower and the property as well. Eligibility is restricted to specific rural areas. It’s very likely that a property close to you qualifies. 97% of U.S land mass is eligible for USDA financing.

USDA loans are also appealing and accommodating to low income consumers. There are income limits to this option and they vary on location and household size. Click here to see them by state and county.

Are you house hunting in the East Valley? Put an address in here to see if the property you’re looking at qualifies for a USDA loan program!

Here’s a few points to keep in mind when you’re house hunting for a home that qualifies for a USDA loan program…

When it comes to buyers eligibility, your credit, income, bank account info and a few other things are compared to current guidelines for the USDA loan program. Some others will be:

-Loan limits

-Employment

-USDA loan debt-to-income ratio (DTI)

-Citizenship

-Credit Score Requirements (Rental History, Payment History, Insurance Payments, etc.)

To learn more, click here!

What’s My Next Step?….

If you think a USDA loan program fits you best, let’s take the next step and fill out the easy to use Online Accelerator HERE! Get a quick estimate of how much you can qualify for and let our team help you move into your dream home. 480-832-4343 dev.sunamerican.com

References:

https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do