For new home buyers there are a lot of different mortgage loans out there to choose from – so how do you decide which is right for you? To keep it simple, today we will cover the two most common programs, conventional and FHA.

It’s important to thoroughly research each type of mortgage loan program and understand the benefits of the different financing options available to you! Our Loan Officers are some of the best in the business and are happy to help walk you through this mortgage loan process!

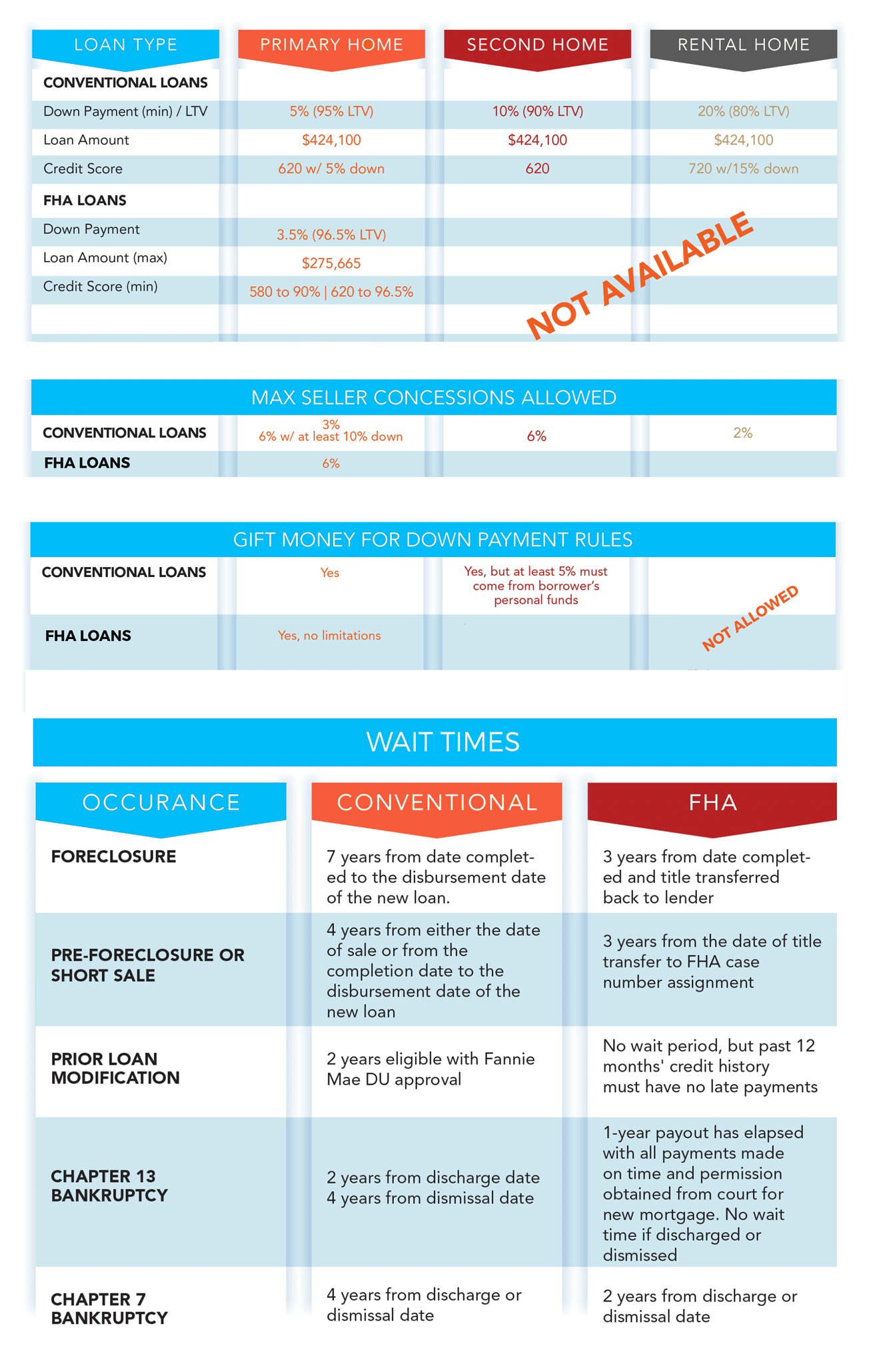

CHECK OUT THE FULL COMPARISON CHART BELOW >>

What is a Conventional Loan?

Our Conventional Loan programs offer fantastic rates and in most cases, faster closings. Unlike an FHA loan program, a conventional loan is not insured by the federal government in any way. While a 3% down option is available, conventional Loans typically work best when a new home buyer is able to put at least 5% down. Most home buyers choose conventional mortgages because they provide the fairly aggressive interest rates, lenient loan terms and the ability to cancel mortgage insurance once the home has a 20% equity position in the event that less than 20% is put down as a down payment.

Conventional Loan qualification is geared towards individuals with a decent credit score (680 or above), solid financial stability, and the required down payment. Just like the other loan types, to qualify for a Conventional Loan, you also must prove a stable income to your lender.

Another great benefit is that with most conventional transactions, mortgage insurance can eventually be removed from the monthly payment. Compared to an FHA transaction, the mortgage insurance remains for the life of the loan when putting less than 10% down.

In direct contrast to an FHA loan, where the mortgage insurance remains in the mortgage payment for the life of the loan when putting less than 10% down. Even with 10% down on an FHA loan you will be required to pay for the mortgage insurance for at least 11 years.

While this information will get you headed in the right direction, there might be other factors in your finances or type of property, that MIGHT make an FHA loan more advantageous. Our expert loan officer’s will help you navigate the finer details as there are many other factors that could play a role in finding the best fit for you.

If you feel like a Conventional Loan fits best for you, the next step is to fill out our easy to use smart online application! Click here to get started!

What is an FHA Loan?

An FHA Loan is a mortgage insured by the Federal Housing Administration. FHA Loans require up front mortgage insurance and monthly mortgage insurance. This protects the lender from a loss if the borrower defaults on the loan. These protections are set in place so that more lenient loan terms can be offered to borrowers who might fall a little short of qualifying for a conventional loan. For example, loans from the Federal Housing Administration are popular for borrowers because they allow individuals to purchase a home with a relatively small down payment. The down payment requirement is only 3.5% – with very aggressive interest rates. The additional layers of protection built into FHA loans pad the banks risk and keep their interest rates anywhere from, .5% to 1% lower than their conventional loan counterpart!

Borrowers with lower credit scores are more likely to get approved with this loan program. Scores can be as low as 580.

It’s a little easier to qualify for an FHA loan because the guidelines are not as strict. Individuals with lower credit scores will have an easier time qualifying for an FHA loan if they can’t qualify for a conventional.

Conventional loans are very particular when it comes to debt to income ratio limitations, which can make it difficult for some buyers to purchase the home that they want.

Some low down payment loans (USDA) have income limitations. However, with an FHA loan, is that there is no minimum or maximum salary requirement that will qualify or prohibit you from getting this mortgage loan.

How To Get Started

We know purchasing a new home is a big step and for many, a brand new chapter in life! We take pride in making this the most memorable and positive experience for you, walking you through every step of the way!

Now that you see how easy it is to qualify- what are you waiting for?! These affordable programs are right at your fingertips and just an application away. Our team of experts have the best programs and love helping home buyers qualify for their new dream home, or refinance their existing one.

Click here to meet our team and get started today! Call us to get a quick estimate at 480-832-4343

Use our Online Accelerator, our easy to use online application! Click here to get started!