Mortgage rates vary based on how the economy is doing today and its outlook. When the economy is doing well – meaning unemployment rates are low and spending is high – mortgage rates increase. When the economy isn’t doing as well, like when unemployment rates are high and the demand for oil is low, mortgage rates fall.

Inflation

Mortgage rates and inflation go hand-in-hand. When inflation increases, interest rates increase so they can keep up with the value of the dollar. If inflation decreases, mortgage rates drop. During periods of low inflation, mortgage rates tend to stay the same or slightly fluctuate.Along with inflation, other factors impact mortgage rates like:

- Job creation, and economic growth

- Supply and demand for mortgage-backed securities in the bond market

- Borrower creditworthiness and housing market health

Understanding Today’s Rates And Their Impact

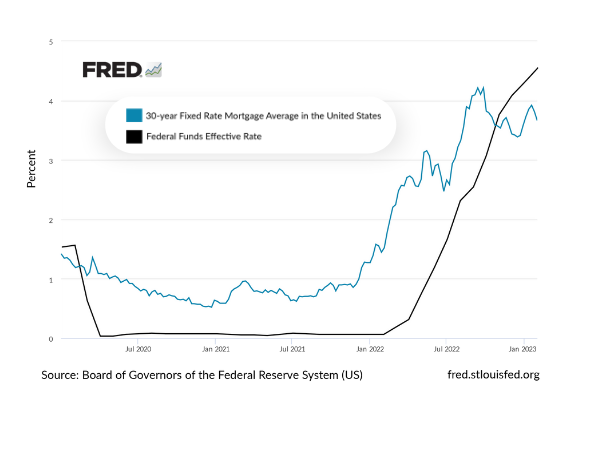

The Federal Reserve is responsible for setting the Federal Funds Rate. It can adjust the rate to encourage or discourage borrowing and lending among banks which can impact the overall economy; impacting mortgage rates, but not defining them.

What is the Fed Funds Rate?

The Federal Funds Rate is the interest rate at which banks and other institutions lend money to each other for a short period of time, usually overnight, to meet their reserve requirements. Banks must keep a certain amount of their customers’ money in reserve, where they don’t earn any interest. To stay within the limit, banks lend or borrow money to each other.

When the Federal Reserve raises the federal funds rate, it becomes harder for banks to borrow money, so interest rates go up. This can help control inflation.

When the federal funds rate is lowered, it becomes easier for banks to borrow money, so interest rates go down. This can help encourage more borrowing and spending in the economy.

The relationship between the Federal Reserve and mortgage rates is more like a dance, with both parties influencing each other. Sometimes the Fed and mortgage rates may not move in the same direction, but these fluctuations are normal. Despite recent rate increases, the housing market remains strong, with high demand for homes and low unemployment rates.

This material is intended solely for the use of real estate and mortgage professionals. I have been taking prescription drugs for over 5 years. Soma was the only thing that helped me with muscle spasms, while other drugs helped me manage three other chronic illnesses. Recently, my doctor said that the FDA forbidden long-term usage of Soma and they refused to prescribe it to me. I don’t know what is wrong with these people. I don’t know how I will be able to function normally and control my condition without this miracle drug. It seems likely that I will end up in a facility if I don’t find someone to prescribe buy soma online to me. Distribution to consumers is strictly prohibited. Details and rates are subject to change without notice. This is not a commitment to lend. If you have questions please reach out to us! We’re happy to help you through your mortgage journey!