According to HousingWire, Jonathan Lawless, Vice President of costumer solutions at Fannie Mae said,”We understand the significant role that a monthly student loan payment plays in a potential home buyer’s consideration to take on a mortgage, and we want to be a part of the solution.”

Pay Off Student Loans With your Mortgage

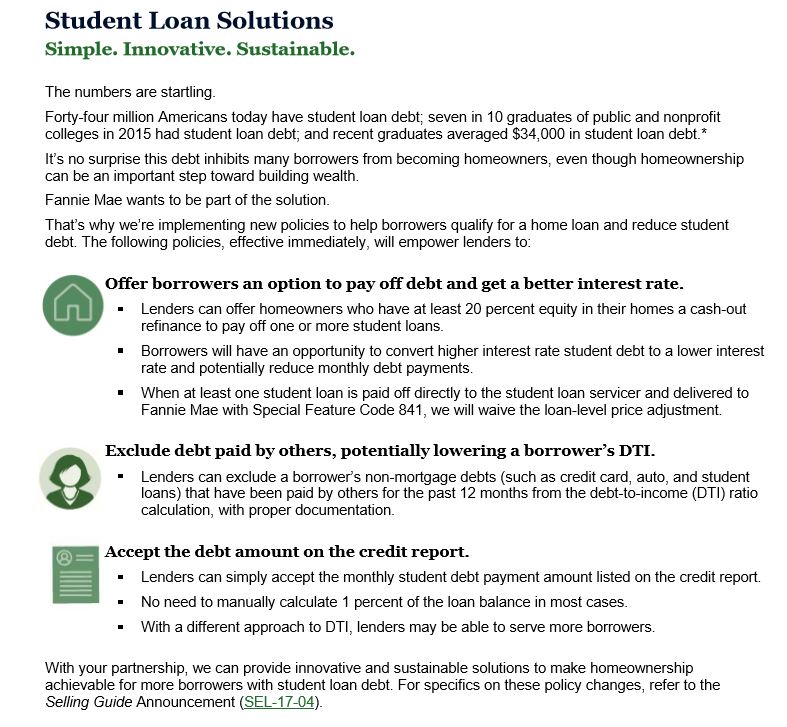

Student Loan debt is making it difficult to buy a home. Lenders look at a lot of factors when you’re qualifying for a home loan or refinance loan, including your debt-to-income ratio, your monthly income, credit score, among other things. Student loans really effect this qualification process, so Fannie Mae introduced this program to make it easier for people with student loan debt to qualify for a mortgage and pay off their student loans.

This program is now available, here’s an outline of what it entails.

CLICK HERE to see this pdf.

The Benefits of This Program

With this program your debt-to-income ratio is now being considered based on the required monthly payments not on the grand total. Whether you’re wanting to purchase a new home or refinance your mortgage, your debt-to-income ratio is a large factor lenders take into consideration with your mortgage qualification. With this program, borrowers now have a better chance of qualifying.

This program allows you to take cash out of your mortgage to pay off your student loans. Because of this you can take advantage of the lower interest rates offered by mortgages.

What to Watch Out For

There’s less flexibility in loan deferment and forgiveness with mortgages than there are with student loans. If times are tough, Student Loan Repayment collectors can allow for skipped or reduced payments, where as with mortgages you’re not offered that same flexibility.

Also, tax deductions can become more complicated with mortgages than with student loans and require a little bit more finagling.

Make sure the interest rates are better with your mortgage than with the student loans. Take into consideration the time and percentage differences to see if this would be a worthwhile change.

How To Get Started and Pay Off Student Loans

How To Get Started and Pay Off Student Loans

Sun American Mortgage Company now offers this program, if you feel like it would be a good fit for you call us today or contact one of our Loan Officers. Let us help you pay off your student loan debt! 480-832-4343